Hindsight is a wonderful thing. Sometimes I look back to my 20’s and wish that I had behaved in a different way with my money. The big piece of essential guidance I would give to anyone in younger life is to put more money aside for later life. I know it’s unpopular to say, but cut back a bit. Live without something to ensure you have some spare money to put aside for the future and put away as much as possible.

Put money each month into an investment account, a simple stocks and shares ISA is perfect. The returns you receive, are far more likely to outweigh returns from savings in cash over the long-term (although there is risk involved and investments can go up as well as down).

Twenty Years ago

Twenty years ago, I was a fresh graduate with great prospects, working for HSBC studying to be an accountant. My starting salary was good, but also my outgoings were high with a mortgage, student debts to be repaid, an expensive commute into London and newly graduated lifestyle to maintain.

Putting money aside was not top of my priorities. I was too young to enrol in the company pension scheme (you had to be 25 back in 1999 to join the company pension scheme). A sigh of relief was breathed that I didn’t have to pay any money towards that thing, ‘retirement’ that felt like an eternity away.

I did open a stocks and shares ISA with a token amount of £25 a month. This was all I could ‘afford’ given my lifestyle and outgoings description.

I wish I had done things differently!

How I wish I had done things differently! If only I had thought, maybe I could put aside £100 a month, from the very first pay packet? Or from the day of getting my first pay rise. I would have known no different and would have got used to not having that money to spend.

Of course, I would have had to go without. I could have gone without the daily coffee on the walk from train station to office (cost of around £50 per month!) or maybe had one less night out per week (cost of around £100 per month). Hindsight, you see, it’s a powerful thing.

Even more powerful is doing some calculations to look at the impact of investing the same amount each month, say, 20 years later. What has all that coffee and partying really cost me?

Investing £25, £50 or £100 over 20 years

Let’s look at a monthly investment of £25, £50 or £100 for 20 years. I have used a prudent assumption of 5% annual return.

£25 investment per month after 20 years is worth just over £10k. This is a rather good return based on total contributions of £6k.

I must point out that I don’t have that 10k (or whatever it might have been worth by now). I withdrew my ISA money to help pay for a house extension back in 2013, 14 years after starting the monthly contributions. After 14 years of investing my £25 per month I had £8k which was around double the amount I had contributed. This is a perfect example of long-term investment. My money earned a great return and came in very handy when I needed it, exactly what should be done with invested money!

But just look at the impact of investing £100 per month! The money is worth £15.5k after 10 years and £41k after 20 years. I could have been sat on a pot of £41k by my current age of 41!

Impact of saving money as cash and an assumption around inflation.

I have spoken to many people who think investing is risky and would rather leave their savings in cash. I will always remind these people that leaving money in cash is also risky. In the long-term, inflation will have an effect and will reduce the value of your cash. Because it’s eats away at your money a little bit each year, most people never really notice it. That makes it even higher risk.

I have done some calculations on the impact of inflation on cash. I assume a savings rate in your bank or buildings society account of 1% and an inflation rate of 2.5% so in real terms the value of your money is falling by 1.5% each year.

Using these figures, s £25 per month after 20 years is worth £5,186. This is £814 less than the £6,000 you would have paid into your account, and it’s because of inflation (Inflation – £1 today is worth less in the future due to the increasing costs of everything we need to buy).

Analysis of a longer time frame

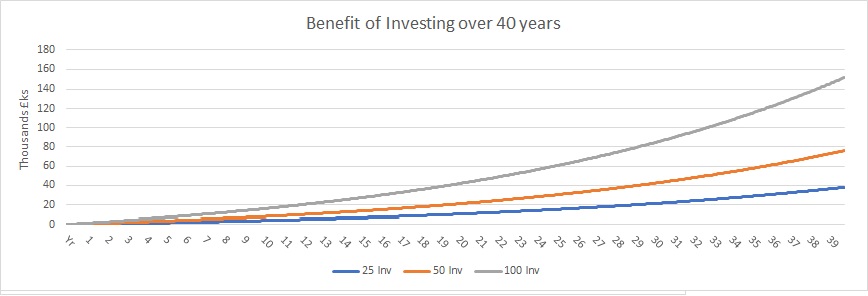

I did a mathematics and statistics degree, and do love to create graphs and analyse numbers. I thought it would be interesting to have a look at the impact of investing different amounts for 40 years. This could be investing into Junior ISA’s for each of my children. These junior ISA’s would be converted into adult ISA’s at the age of 18. Leaving the money there until they are in their 40’s. What could £25 be worth?

Turns out the small amount of £25 invested per month could be worth £38k! This is based on actual contributions of just £12k, demonstrating the power of compound returns!

I would personally struggle to invest £100 per month for each child, but if you could, wow, this could be worth £153k after 40 .

Some families choose to invest their child benefit and transfer the payment straight into a Junior ISA from the date they start receiving it. I get £180 child benefit per month for three children. If I assume this amount stays the same and I invested it for 18 years, its worth £63k at the end of the 18 years. That is an impressive return.

Where Can I invest?

Many of us struggle for time and want a simple solution to look after our money, giving us the possibility of a great return. Investments give you this opportunity over the long term when market conditions are good, but this isn’t guaranteed. The Vanguard LifeStrategy funds are super simple to set up, low in fees and have a proven track record of great returns.

The LifeStrategy fund range has five funds to suit different risk appetites. LifeStrategy 20% Equity has a low amount invested in shares so is relatively low risk, compared to the higher risk LifeStrategy 100% Equity fund which is fully invested in shares and is much higher risk. The other three funds in the range sit between these two with a more moderate amount of risk. The longer you are planning on leaving your money in this investment the more risk you can take. I personally invest in the LifeStrategy 100% Equity fund as I know my money is in there for at least 10 years. I want a higher return and am prepared to take the risk.

Past performance in no way can predict future performance, however looking back at the performance from the past five years the returns have been good. 2016 was a great year with returns of over 20%!

Super Low Fees

The fees for investing with Vanguard are extremely low and compare very favourably to their competitors. There is super low account fee of 0.15%, this is much lower than most other platforms I have looked at. There will also be a fund charge of between 0.06% and 0.8% which will be deducted from your returns before you receive them. The LifeStrategy funds charge 0.22%. That means that for a £1,000 investment, the total cost for one year will only be £3.70 including the cost of the fund and the platform.

Reflecting back in time to my younger self

I can now look back with clarity and really wish I had invested more. When you focus on the amounts that I ‘could’ have had by now it is frustrating that I didn’t focus more on the future and save more. Damn those daily coffees.

But its never too late! Start on that investment journey now and open a Stocks and Shares ISA before the end of the tax year on 5th April.

Read Faith Archers post for a different perspective on Investing – The cost of delay

You can also read about Faith Archer’s views on Investing – The cost of delay here, also working in collaboration with Vanguard. We would love you to join us on 14th March 1pm to 2pm for Twitter chat with Vanguard. I will be back with reminders on social media closer to the time.

Please be aware that any form of investment can go up and down and you may want to consider advice from a qualified IFA. Just make sure they are recommended by a trusted friend and check their investment levels as some will only work with clients with an investment level of at least £150k. This post was written in collaboration with Vanguard.

3 Responses

Excellent stuff, thanks for sharing.

You wouldn’t believe how often I hear from clients in their 50’s that they wish they started younger.

This post is great at explaining the cost of NOT investing and the importance of starting young.

Keep up the great work. 🙂

Thanks for sharing!