Buying a home is probably one of the most expensive things you’ll ever do in your life, which is why it’s vital to take care of significant financial responsibilities before you even consider saving for a deposit. So to help you out, here are five of the most important financial responsibilities to take care of as quickly as possible.

- Sort out your budget and salary

The first thing to consider is sorting out your budgeting priorities. If you haven’t set up a budget and don’t look at your finances every week then you probably aren’t optimising your incoming and outgoing.

- Pay off loans and debts as early as you can

The less debt you have the less financial stress you’ll experience when saving for a home. Pay off loans, consolidate debts if needed and don’t allow your credit score to drop.

- Work on boosting your credit score

Make sure you pay your bills on time, don’t borrow money you can’t pay back and never be late with repayments to increase your credit score.

- Start a healthy savings account

A savings account will help you build up the money needed for a deposit, but you need to get into the groove of saving your money and leaving it there to accumulate instead of relying on it.

- Look at mortgage advice

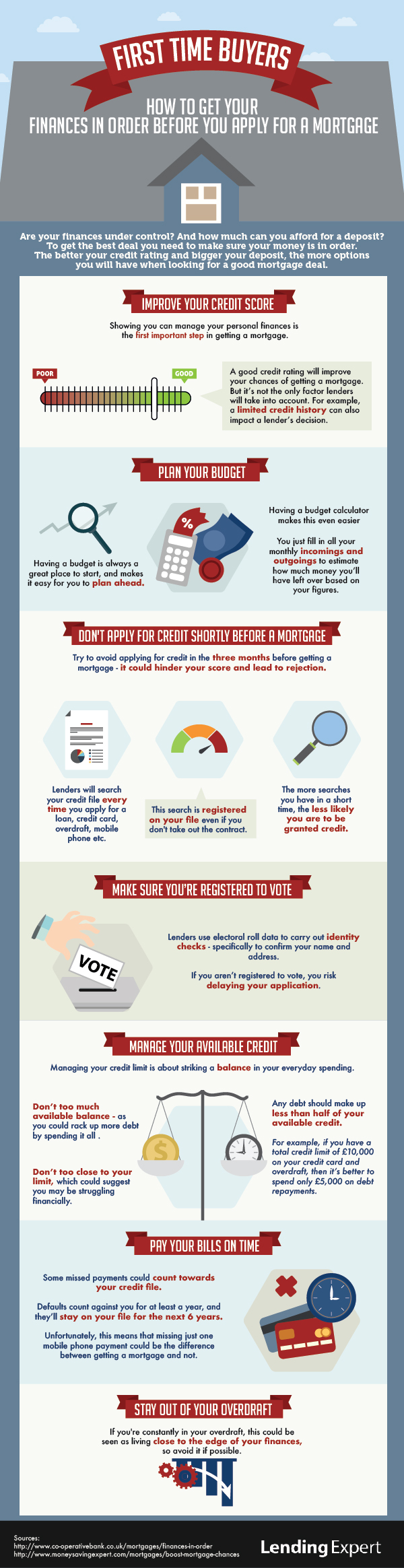

There are plenty of places to seek mortgage advice and we’ve attached a fantastic infographic to help you out.

Graphic from Lending Expert

This is a collaborative post.

One Response

Thank you for sharing! Buying a home is a big step, but it is the main goal of this year. We are now looking at clear path lending reviews, studying the conditions to clearly understand whether we can handle it. But I understand that it gives us really good opportunities.