Emotional Spending

The idea for this post came to me during a conversation with my good friend Andrew. He gives me the occasional business/life coaching session when I need it. He knows me well; Andrew was my boss when I was a digital sales manager at EE, and we have been good at keeping in touch despite not working together for around six years.

We were talking about my debt, and he said that I needed to watch out that I didn’t retreat into a spending spree mindset. You see he was there when I got carried away during 2018 and saw what I did, what I spent and what impact it had on my cash flow and my mental health.

He was concerned that I had got to a point of being debt free. And to a point where I had money. And that my immediate reaction would be to spend that money.

Losing Control, my Emotional Spending This Week

You see this is what I do. When I am feeling secure with the amount of money I am earning or have a good chunk of money saved, I lose control of any restraint I may have had before, and I just spend.

I declared I was debt free on Wed 1st May 2019. On Thursday 2nd May I celebrated my debt free status by heading out to EE and getting myself a smartwatch. Some will read this and think; ah don’t worry its about time you treated yourself to celebrate the debt ending. Some will shake their heads knowingly.

My thoughts were woo hoo, I have money, I don’t have to put £1000 of my hard-earned cash into my credit cards anymore. So, I treated myself. The watch cost me £85 on the day plus a small amount each month over the term of a 24-month contract.

I also took the boys out for dinner, thinking that we deserved a treat. That was £50 spent. Plus, there was my currency left over from Vegas. I had $300. I could have turned that into £230. No, I decided to turn $200 of it into a Debenhams shopping voucher of £170 worth as they gave me 20% bonus on to top of their buy-back rate. But it will be spent on stuff, not going straight back into my bank account.

Altogether this week I have spent around £300 on stuff. Stuff for me. Treat food for the boys and me. Stuff that is disposable.

Getting back control

I know the emotional spending has kicked in. And I must get it under control.

I have done this before; I have won the battle against that devil sat on my shoulder and I can do it again. My plan is as follows.

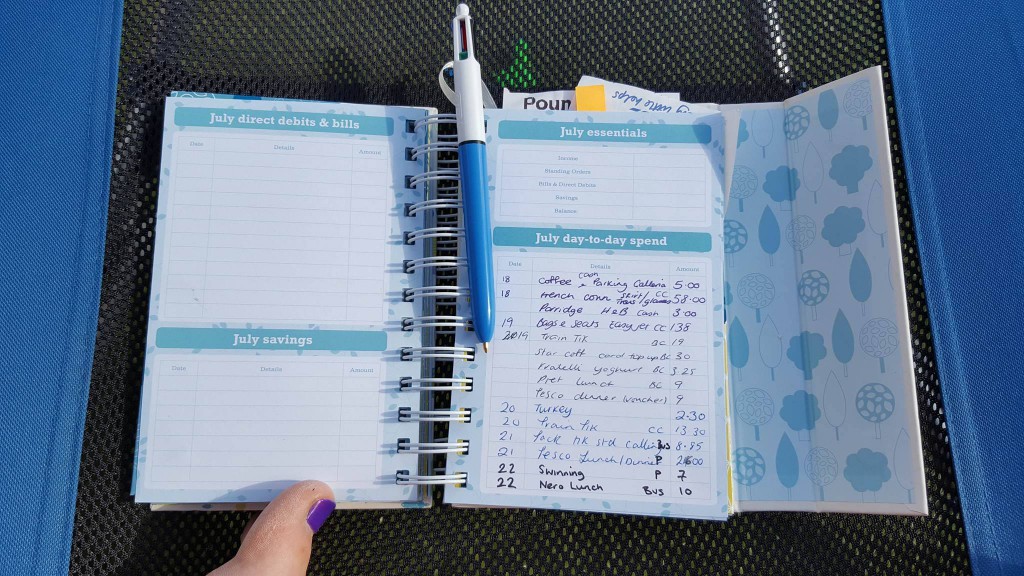

- Write everything down. I started the year writing every bit of spending down into a diary. I did this for three whole months Jan to March. Then I lost the plot in April and gave up. This will start again. That diary will go everywhere with me and at the end of EVERY day I will write down exactly what has been spent.

- I will not make impulse decisions about buying stuff. The Samsung watch was a complete impulse. An EE person called me up offering me a deal, I spoke to my friend who owns Hitchin EE to see if he could beat the deal, he could, and I was sold. I watched a super clever YouTube video from Samsung, and I was completely convinced that this watch would change my life. (To be fair its pretty special and I do really love it, footstep count of 11k today #justsaying). I WILL NOT MAKE IMPULSE BUYING DECISIONS.

- I absolutely will not be making any drastic decisions about business investment. Last summer I spent (scarily looking at my FreeAgent accounts from last summer) around 6k by the end of August on business investment. So far, I have had a return of around £1k on that, not a great return on income so far.

- Speak to my emotional spending buddies. I have private Facebook chat with a couple of other money writers who also have emotional spending tendancies. I am finding that a great help to share when I have done it. There is no justification or judgement, we just share what we have done. And talk about when it gets hard, trigger moments, things that help. Nicola is one of these friends and has written about her thoughts on emotional spending here. Plus, there is Hollie of Thrifty Mum, one of the most positive and resilient people I know.

I have accepted that I have a problem and I have a plan on how to address that problem. I feel confident that I can get it under control.

Emotional spending will not impact my finances ending with me going back into debt.

4 Responses

Lynn, I think so many people will identify with you and the struggle of separating emotion and expenditure. We want instant gratification for that feel good feeling but need to channel this in another direction. The boys won’t care if it’s a £50 meal or a £3 picnic. They love their time with their mum x x

Exactly this. In fact they would prefer a £3 picnic as it would be at the park and they can play football!

Good for you in identifying your spending triggers, and thinking about how to manage them. Many cheers for spending diaries!

Spending diaries are the answer!! Maybe not to life, but certainly to emotional spending!