Well what can I say, how much have things changed in one short week. We are pretty much on lockdown, self-educating our kids and social distancing. But we can do this, we have no choice. We have to adhere to the rules to slow down infections and deaths.

I know so many are worried about money. Many have lost their jobs or at risk of losing jobs. Many of you, us are self employed and are worried about the flow of money in coming months.

I think there is little point thinking too much about the future, we almost just need to focus on the now, conserve as much money as possible. Its really important to only spend on essentials and cut back on as much cost as possible. Regular bills such as Sky, Gym memberships and other subscriptions can be paused.

Essential bills such as water, energy, mortgage companies are being flexible with payments where holidays can be taken or payments re-structured. If you feel like things are tight right now take this action immediately and ask for help from your regular bills. I wrote this post to help with money saving and money making ideas, have a read for some inspiration and see what actions you can take to save money.

On to my Money Saving Week

I am now the Proud Sole Owner of my house

Amidst all the chaos of last week my re-mortgage all went through. And the most important part of this was that my separated ex-husband finally moved out of my house. We split up in June 2019 and he stayed in the house, refusing to move out. Ten long months later the money situation has all been resolved and he has gone.

The relief was huge, immeasurable. Its only now I can look back and see how difficult it was, the mental torture of living with someone who you didn’t want to be with any more. You can read more about why we split up here, as it wasn’t a decision taken lightly, but it was 100% the right decision.

So yes I am now the owner of the family home. I bought the ex out and that money transferred on Thursday morning. I then had to pay the solicitor bill (£5k in total, which was totally the number that I had been told it would cost) and also repay two of my wonderful friends who lent me cash in January when I needed unexpected emergency cash.

The remainder money left with enough to pay another tax bill in September, my corporation tax bill. And then £1000 of cash. This has gone straight into emergency pot. I did a manual transfer and put the money into my Chip auto-savings account. Chip coincidentally is still offering a £10 bonus if you want to open an account. Totally worth it for a free tenner and a nifty auto-save account that builds up an emergency fund without you noticing. Use the code Mummypenny10 to get the free £10!

Money Saving Tactics

On a weekly basis I am currently checking both my Octopus Energy and Top Cash Back accounts for money that I can transfer to my bank account. I found £150 last week that went straight back to my bank!

Every now and again I get a person signing up to Octopus energy and when there switch goes through we BOTH get a £50 credit to our bills. So every time one of these appears in my account I grab that money and put it into my bank account. If you are feeling like your energy bill is too high, do a quick check to see if you can save yourself money, plus you’ll get that £50 credit!!

Most of my transactions currently are online so I make sure they are always completed via my Top Cash Back account. I sent some flowers to my sister for her birthday and got £3 cash back. Also I bought a train ticket for a work job last week and got £5 cash back. I urge you set up an account and save an extra bit of cash on your online transactions. This is my refer a friend link where I will receive a small payment for you signing up.

Spending Diary

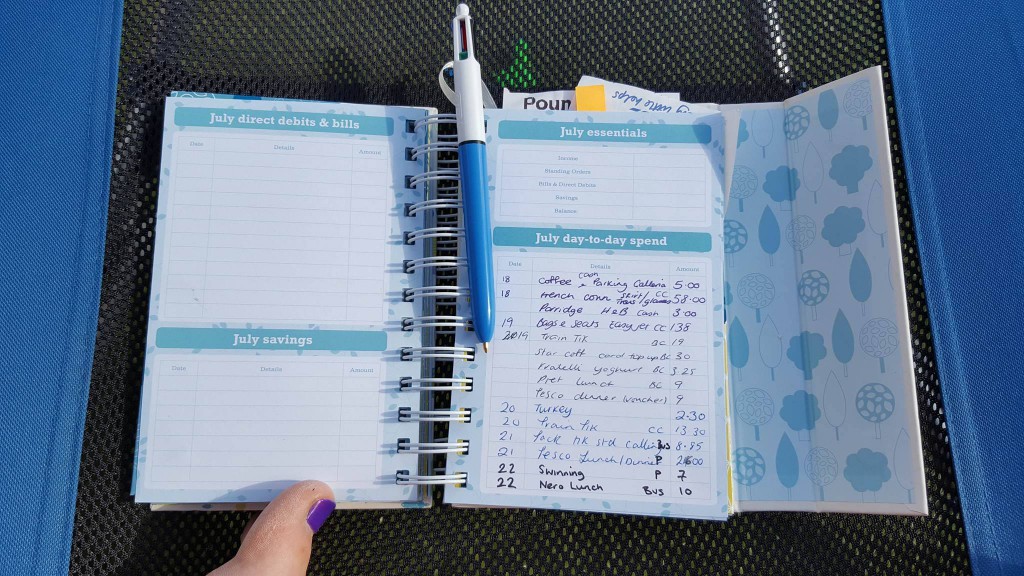

Now is the most important time to keep a track on spending so I have re-introduced my spending diary. And to make it a bit more fun I am working in conjunction with Faith from Much More With Less. We will be keeping spending diaries for the next few weeks and will be comparing and writing about it for PensionBee.

We are both keeping detailed spending diaries during this time of isolation. It is going to be so interesting to compare our spending whilst we cant get out to do much. And interesting to see how much the takeaway food bill increases by.

I managed to have a no spend day on Saturday. Sunday saw me make a quick dash to Tesco, ensuring I went no where near another person (it was 5pm in the afternoon and was quiet!). I bought in a few essentials for the boys, cookie making ingredients and a luxury item, new bed sheets. The past ten months have been spent on the sofa bed in the spare bedroom and now have my bed back so I made sure that I got new sheets.

Holiday Cancellation

As you may remember from previous posts I was meant to be flying to Antigua on 21st March. This obviously had to be changed. Most of the cost of the trip can be moved to later in the year, except for the Air BNB accomodation who are saying the money is gone. So I am making a cancellation claim on my travel insurance.

The flight was booked with Netflights who have been ignoring my emails and calls since Thursday, so instead I called American Express and they have refunded me the money via a chargeback. £437 straight back into my account, a much needed boost to my emergency funds.

I am gutted to miss out on the holiday, but know it has been rescheduled and I shouldn’t be out of pocket.

Wednesday Pensionbee Photo Shoot

A lovely thing that happened last week was my last day of client work for a while. I did an outdoor photo shoot with PensionBee. The journey was on a very empty train to Manchester and spent the afternoon with the agency team. I had my hair and make-up done and wardrobe was provided too. We went to the main library in Manchester for the shoot and spent some time getting the perfect shots.

It was such fun, we had the best time and I loved being a model for the day. I cant wait for the campaign to be out so I can share, but I will be all over bill boards and digital advertising soon!! My job is the best!

To learn more about PensionBee this is a great place to start, when they helped me to sort out my pensions mess.

Chance to win one of five hampers!

I have teamed up with some of the UK money bloggers to bring you the excitement of a competition, to help a bit with current times. Go to competition post here with details on how to enter!

This post contains affiliate links where I receive money if you sign up, and links to sponsored posts. These links in no way affect the price you pay and if you do sign up, THANK YOU for helping me to keep Mrs Mummypenny going during these tough months.

One Response

Hi Mrsmummypenny – I wanted to ask you for a bit more detail on your Amex chargeback with Netflights. I’m in the exact same predicament with Netflights – flight due to depart in less than 24 hours and the country is barring foreign visits!

Did you do this over the phone? I’ve been on hold with Amex for over an hour and no one’s spoken to me yet..

What reason did you have to specify for your chargeback? I’m trying to do it online, but experience has told me that the exact reason is important. ‘Coronavirus pandemic’ not yet a listed reason…

Would appreciate any help you can give me, thanks!